Strategic Metals Ltd plans geophysical surveys at three highly prospective Porphyry Copper projects in Yukon

June 2, 2022 – Strategic Metals Ltd. (“Strategic” or the “Company”) is pleased to announce details concerning exploration programs it will conduct during summer 2022 at three of its wholly owned porphyry copper projects in southwestern Yukon Territory. The programs will involve geophysical surveys designed to better understand the three-dimensional geometry of the porphyry systems. Induced polarization (IP) surveys will be done at the Mint and Alotta projects, and helicopter-borne magnetic and radiometric surveys will be flown at the CD property.

“The geophysical surveys are designed to follow-up on encouraging results obtained from earlier exploration programs at these highly prospective porphyry prospects” states Doug Eaton CEO of Strategic. “The geometry of the systems is difficult to establish through surface work alone because two of the prospects are in unglaciated areas of Yukon where deep weathering and metal leaching are common, and the third is a young, high-level porphyry where erosion has exposed only the very top of the system. The information from these surveys combined with current data, will allow for three-dimensional modeling that can be tested by future drill programs.”

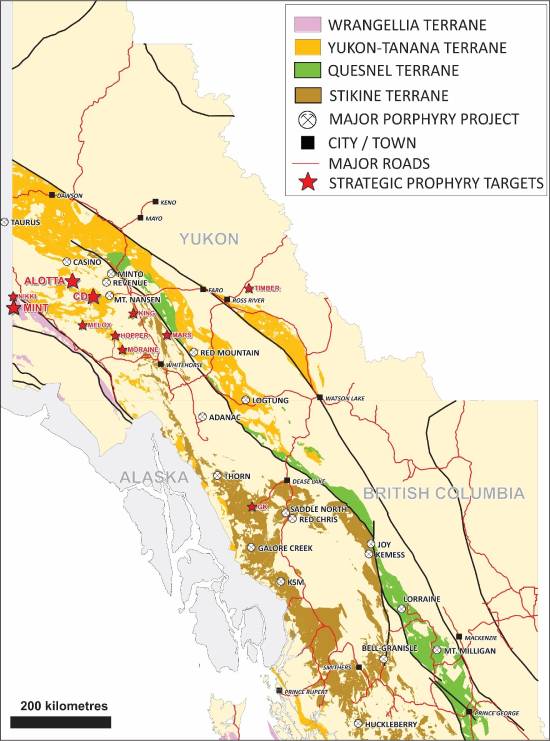

The Mint, Alotta and CD are three of eleven porphyry projects Strategic owns within a prolific porphyry belt that extends the length of British Columbia, through western Yukon and into Alaska.

Mint Project

The Mint project is a 50 sq km property located 26 km south of the Alaska Highway. It is one of the youngest porphyry systems in Canada and is hosted in within Oligocene-age granodiorite and porphyry dykes with alteration and mineralization permeating into a nearly coeval, overlying basalt unit.

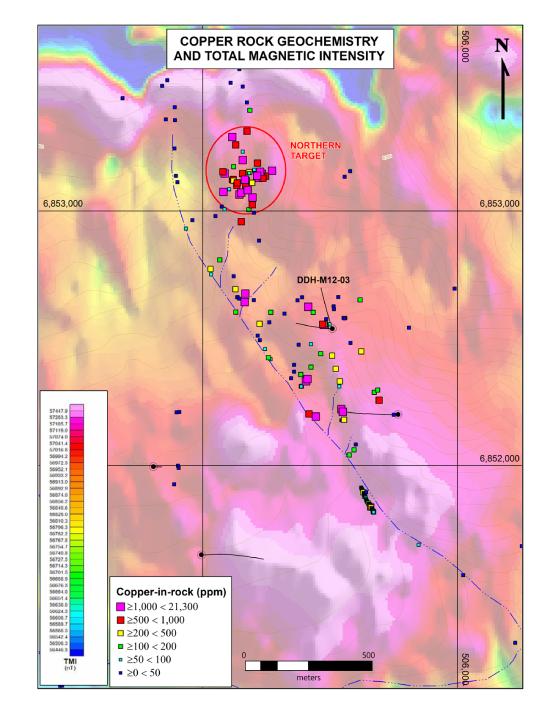

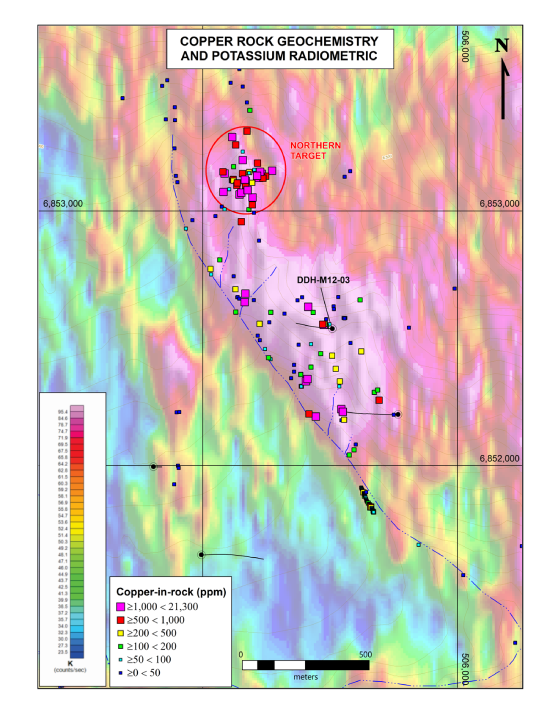

Work programs conducted by the Company since 2010 have outlined interesting geochemical and geophysical features that are centered on a zone of hydrothermal alteration, marked by a prominent gossan. Soil geochemistry has returned strong copper, gold and molybdenum values within an area about 2000 m in diameter. A prominent magnetic high that underlies the southern part of the area is flanked to the north by a zone with elevated potassium radiometrics. The northern part of the area of interest is mostly covered by talus while the southern part is blanketed by glacial and eluvial material. An IP survey that covered the southern part of the area of interest identified chargeability highs that partially coincide with the core of the magnetic high. In 2012, six relatively short, diamond drill holes tested in and around the magnetic and chargeability anomalies. Most of these holes intersected strongly fractured, phyllic altered rocks that returned moderately to strongly enriched gold values but only weakly elevated copper and molybdenum values. The best results were from the most northerly hole (M12-03), which averaged 0.204 g/t gold over its entire 331 m length, including a 53 m interval grading 0.556 g/t gold near the bottom of the hole. This hole lies just north of the magnetic high, in the southern part of the potassium radiometric anomaly.

In 2021, detailed mapping and prospecting discovered a 300 m in diameter area containing well mineralized, stockwork and sheeted quartz veining, about 800 m north of hole M12-03. This northern target lies within the potassium radiometric high and shows moderate to weak magnetic response. It was not covered by the historical IP survey. Rock samples collected in 2021 from the northern target contained much more copper and molybdenum than those collected elsewhere in the Mint porphyry system and returned strongly elevated results, including peak values of 2.3% copper, 1.365 g/t gold, 32 g/t silver and 0.337 % molybdenum.

The planned 2022 IP survey will expand coverage to include the newly discovered zone of mineralization. Once interpreted, the results should provide more information concerning lateral and vertical zonation of mineralization and alteration within the porphyry system, which will guide future drilling.

Alotta Project

The Alotta project is located 40 km south of Western Copper and Gold Corporation’s Casino porphyry deposit, which hosts 2.4 billion tonnes of M&I resources containing 7.6 billion pounds of copper at 0.14% and 14.5 million ounces of gold at 0.19 g/t*.

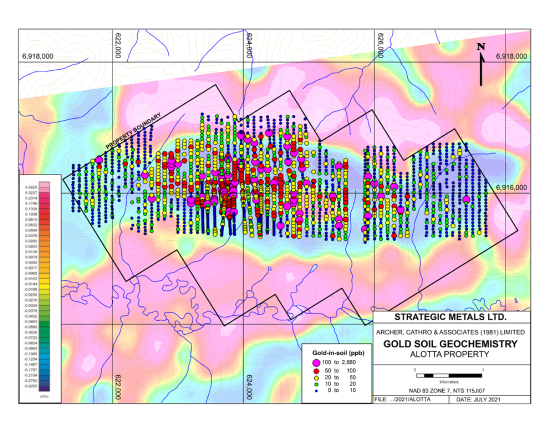

The 15 sq km Alotta property covers a broad magnetic low that corresponds to a zone featuring high-level dykes, brecciation and pervasive phyllic and potassic alteration. This zone is developed within a large pluton that elsewhere consists of unaltered, magnetite-bearing granodiorite. The magnetic low is the result of sulphide replacement of magnetite within the altered zone.

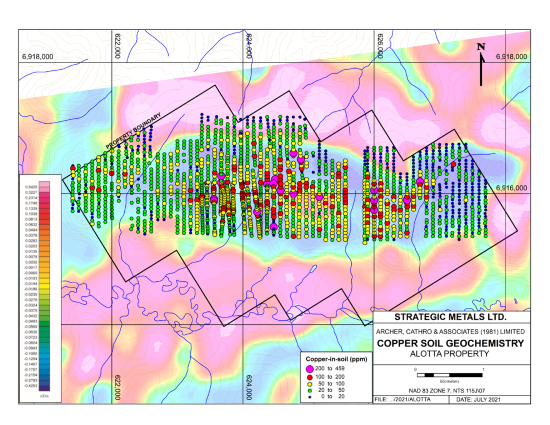

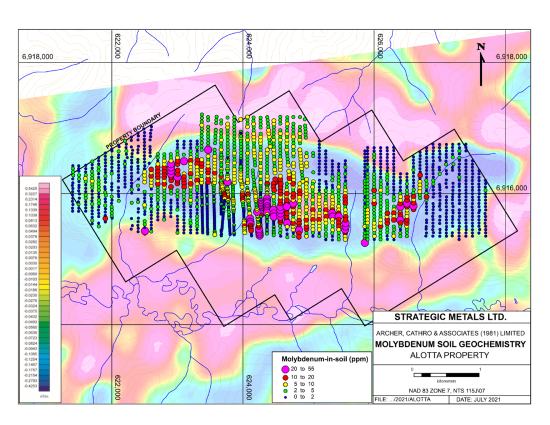

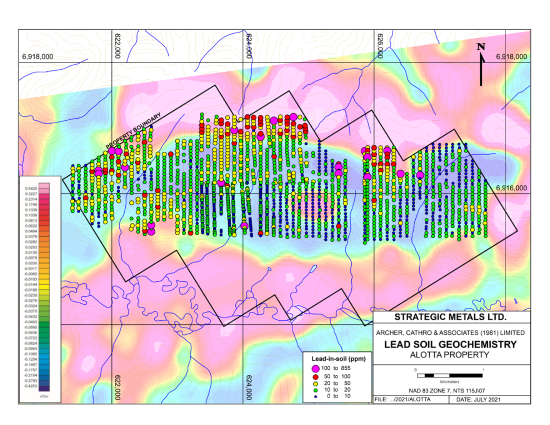

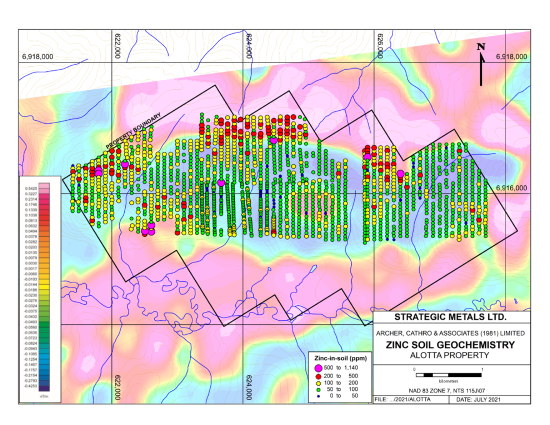

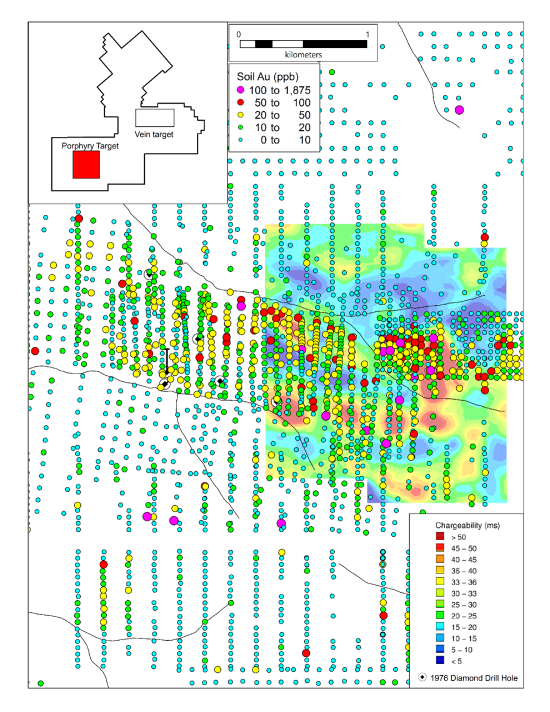

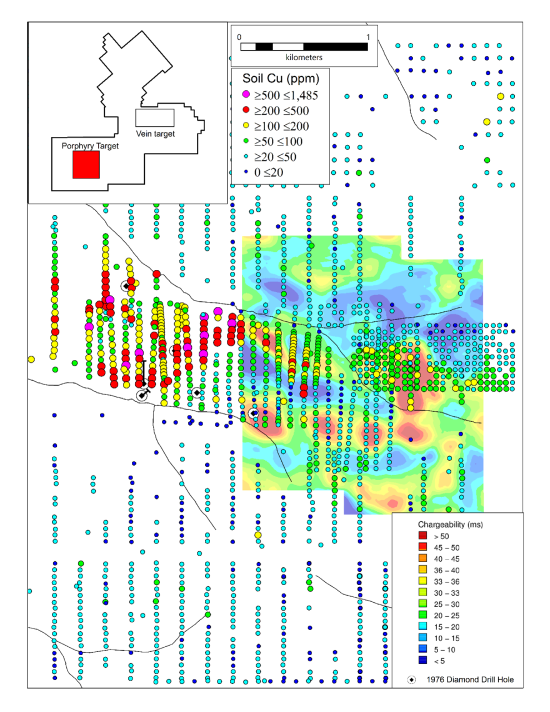

Soil geochemical surveys conducted by the Company have outlined a very large, multi-element anomaly that closely coincides with the magnetic low. The anomaly shows classic porphyry-style metal zonation with a 4200 m long by up to 1500 m wide core of strong copper and molybdenum values flanked by high lead, zinc and silver results. High gold-in-soil values, which reach a maximum of 2680 ppb, occur throughout the entire area of grid sampling and likely relate to both the porphyry mineralization and fringing vein systems.

The Alotta project and nearby Casino deposit lie within the unglaciated portion of Yukon, which is characterized by deep weathering. The Casino deposit has been subject to intense leaching of mobile metals, which has resulted in a thick, gold-enriched but copper-depleted, leached cap that sits atop a zone of supergene, copper-enriched sulphides and deeper, hypogene sulphides. Most rocks collected from surface at Alotta contain limonite-coated pits and fractures, and sulphide minerals are rare. No holes have been drilled yet on the property, so the depth of weathering is unknown.

There is almost no outcrop on the Alotta property and most parts are heavily vegetated. Work by the Yukon Geological Survey has shown that residual rocks and soils in similar settings in western Yukon are typically blanketed by a thick but intermittent layer of eluvium and younger volcanic ash. These features, coupled with the deep weathering and localized metal leaching, hamper the effectiveness of prospecting and can dampen analytical values for mobile metals, like copper. Despite these limitations, soil geochemical sampling at Alotta has produced encouraging results and rock sampling has yielded elevated values, especially for gold. The highest values obtained to date from rock samples are 0.44% copper and 8.73 g/t gold.

The IP survey planned for the Alotta property should give some indication as to the depth of weathering and the nature alteration and mineralization in the underlying porphyry system.

CD Project

The CD project is a 277 sq km property that lies 20 km west of the road accessible, Klaza gold-silver deposit owned by Rockhaven Resources Ltd. The setting at CD resembles that of Klaza and the Casino deposit further to the north, with epithermal veins flanking a porphyry system.

The CD property was identified soon after the Casino deposit was discovered in the late 1960s, and early exploration efforts focussed on an area of strong copper-in-soil geochemistry in the lower part of a west-facing valley. A few shallow drill holes, which tested this target intersected relatively fresh unmineralized rocks.

Soil geochemical and IP surveys conducted by Strategic have identified an area of strong gold-in-soil anomalies uphill to the east of the copper anomalies, which coincide with a well-defined trend of chargeability highs and coincident resistivity lows. There is no outcrop in the area of these anomalies, and much of the area is blanketed by frozen eluvium and younger volcanic ash. Mapping of rocks taken from soil near the gold-in-soil and IP anomalies crudely outlined areas of porphyry-style alteration and brecciation. All of these rocks were strongly weathered and no residual sulphide minerals were reported.

The exploration model at the CD project envisions leaching of copper from near surface rocks located on the upper slopes and hydromorphic transport of the copper in acidic groundwater down gradient to the west, before it is reprecipitated in organic-rich soils on the nearby, valley floor. The less mobile gold would be left behind when the copper is leached, marking the source area. At the Casino deposit, there is a well-developed leached cap and an area where copper-enriched springs come to surface, creating a transported soil anomaly downstream of the deposit.

The planned helicopter-borne magnetic and radiometric surveys will be flown by Precision GeoSurveys Inc. and will compliment the earlier IP data and may help to identify lithological contacts and zonation within alteration related to the porphyry system.

Technical information in this news release has been approved by Heather Burrell, P.Geo., a senior geologist with Archer, Cathro & Associates (1981) Limited and qualified person for the purpose of National Instrument 43-101.

*Form 43-101F1 Technical Report, Preliminary Economic Assessment, Yukon, Canada. Effective date: June 22, 2021, Issue Date: August 2, 2021. Prepared by: Roth, D., Hester, M., Marek, J., Tahija, L., Schulze, C., and Friedman, D.

About Strategic Metals Ltd.

Strategic is a project generator with 11 royalty interests, 9 projects under option to others, and a portfolio of more than 100 wholly owned projects that are the product of over 50 years of focussed exploration and research by a team with a track record of major discoveries. Projects available for option, joint venture or sale include drill-confirmed prospects and drill-ready targets with high-grade surface showings and/or geochemical anomalies and geophysical features that resemble those at nearby deposits.

Strategic has a current cash position of approximately $7.3 million and large shareholdings in several active mineral exploration companies including 32.8% of Broden Mining Ltd., 34.5% of GGL Resources Corp., 31.6% of Rockhaven Resources Ltd., 19.6% of Honey Badger Silver Inc., 15.7% of Precipitate Gold Corp. and 17.2% of Silver Range Resources Ltd. All these companies are well funded and are engaged in promising exploration projects. Strategic also owns 15 million shares and 5 million warrants of Terra CO2 Technologies Holdings Inc., a private Delaware corporation which recently completed another large financing to advance its environmentally friendly, cost-effective alternative to Portland cement.

ON BEHALF OF THE BOARD

“W. Douglas Eaton”

President and Chief Executive Officer

For further information concerning Strategic or its various exploration projects please visit our website at www.strategicmetalsltd.com or contact:

|

Corporate Information Strategic Metals Ltd.

|

Investor Inquiries Richard Drechsler

|

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of exploration and other risk factors beyond its control, and actual results may differ materially from the expected results.