Strategic Metals adds Craig silver-lead-zinc deposit to its Crag & Rod Projects, east-central Yukon

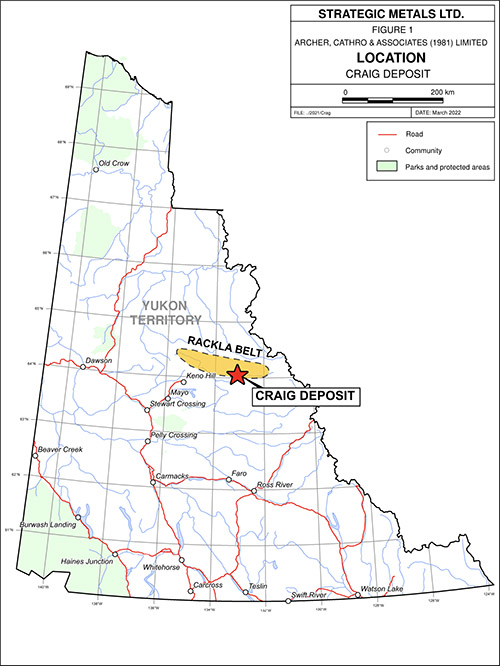

Vancouver, B.C. – March 17, 2022 – Strategic Metals Ltd. (TSX-V: SMD) ("Strategic") is pleased to announce that is has acquired through staking the Craig silver-lead-zinc deposit, located between its wholly owned Crag and Rod projects in east-central Yukon. The Crag and Rod projects are situated in the Craig Belt, a subset of the 175 km long Rackla Belt, which is known for its high-grade silver-lead-zinc and gold deposits.

"The Craig Deposit is a key asset with a historical, inferred mineral resource estimate of 874,980 tonnes grading 123.4 g/t silver, 8.5% lead and 13.5% zinc*" states Doug Eaton, Strategic's President and CEO. "There is excellent potential to expand this historical resource and to outline new deposits within the highly prospective but under-explored Craig Belt, which Strategic has now fully consolidated."

*Resources were estimated by Falconbridge Limited in the mid-1990's before the implementation of NI43-101, and therefore considered historical in nature. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or reserves and the issuer is not treating the historical estimate as current mineral resources or reserves.

The Craig Deposit is situated approximately 145 km northeast of Mayo (Figure 1) and 10 km south of the Rackla Airstrip, a primary staging point for exploration programs in the Rackla Belt. Combined, the Crag and Rod projects comprise 1569 contiguous mineral claims, encompassing 31,200 hectares (312 km²). The claims cover numerous MVT-type and vein-hosted silver-lead-zinc occurrences and areas with Carlin-type pathfinder mineralization and alteration. The claims are located within the traditional territory of the Na-Cho Nyak Dun First Nation.

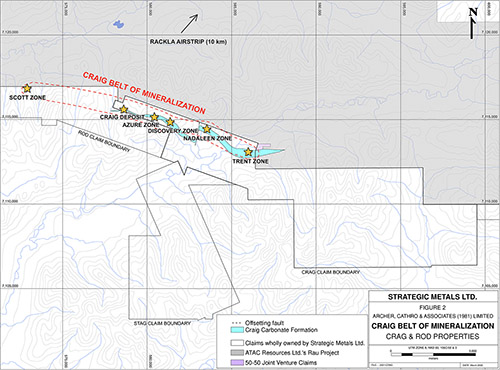

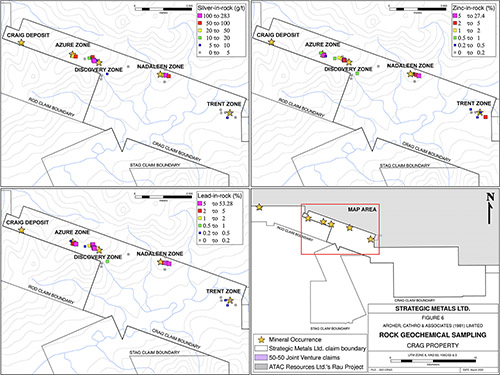

Mineralization in the Craig area was first discovered in 1976 and, during the next few years, surface exploration and shallow diamond drilling identified a mineralized trend known as the Craig Belt, which includes six highly prospective silver-lead-zinc±copper occurrences: the Craig Deposit and Discovery, Trent, Azure, Nadaleen and Scott zones. Most of the mineralization in the Craig Belt is hosted within a southeast-trending unit of dolostone and lesser limestone belonging to the Algae Lake Formation, which can be traced along surface for over 6000 m and is up to 300 m wide (Figure 2). This unit is informally referred to as the Craig Carbonate Horizon.

Strategic staked its first Rod claims in 2008 to cover high-grade silver-lead-zinc veins, and in 2010 it expanded the Rod property and staked the Crag claims as part of a major staking rush that followed the discovery of Carlin-type gold mineralization in the Rackla Belt. During this staking rush, Strategic acquired most of the Craig Belt, but a few claims covering the Craig Deposit were still held by a major mining company. When those claims expired in late 2021, the Craig Deposit was immediately re-staked by Strategic.

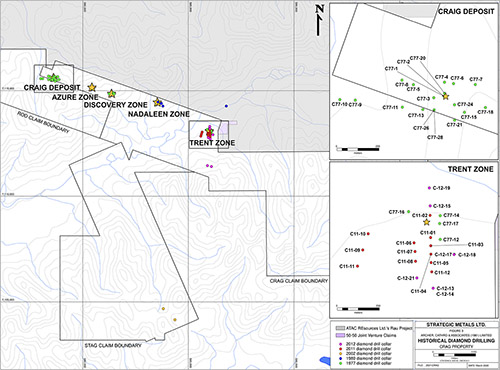

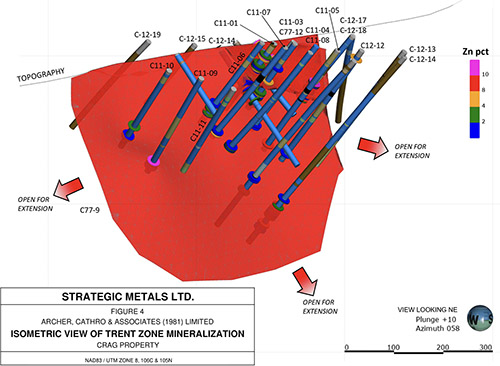

Past work by Strategic in the Craig Belt mainly focused on the Trent Zone, where Carlin-type pathfinder minerals and alteration occur in the hanging wall of the silver-lead-zinc zone. Several diamond drill holes completed by Strategic Metals in 2011 and 2012, which were designed to test the Carlin-type targets, also intersect significant MVT-type silver-lead-zinc mineralization (Figures 3 and 4).

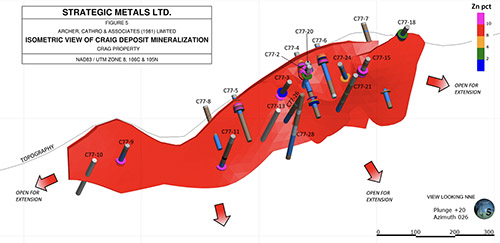

At the Craig Deposit, diamond drill programs performed between 1977 and 1980 resulted in an inferred, historical mineral resource estimate of 874,980 tonnes averaging 123.4 g/t silver, 8.5% lead and 13.5% zinc*. Since staking the claims covering the Craig Deposit, Strategic has completed 3-D geological modeling of the Craig Deposit and Trent Zone (Figures 4 and 5). This modelling suggests that both areas of mineralization are open to expansion, along strike and to depth.

*Resources were estimated by Falconbridge Limited in the mid-1990's before the implementation of NI43-101, and therefore considered historical in nature. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or reserves and the issuer is not treating the historical estimate as current mineral resources or reserves.

Only limited drilling was done at the Discovery and Nadaleen zones, which returned highly encouraging results, and the Azure Zone has not yet been drilled.

Highlight results from historical drill holes at the Craig Deposit and Discovery, Nadaleen and Trent zones are tabulated below.

|

Zone |

Drill Hole |

Interval (m) |

Length (m) |

Ag (g/t) |

Pb (%) |

Zn (%) |

AgEQ (g/t)¹ |

| Craig | C77-1 | 46 - 48.7 | 2.7 | 89 | 12 | 10 | 895 |

| and | 59.2 - 64.3 | 5.1 | 49.8 | 6.3 | 13 | 835 | |

| C77-3 | 76 - 77.9 | 1.9 | 16.3 | 0.9 | 22 | 1069 | |

| including | 82 - 87.8 | 5.8 | 100 | 10.3 | 19.5 | 1301 | |

| including | 85 - 87 | 2 | 249 | 25.1 | 35 | 2592 | |

| C77-4 | 26.8 - 62.9 | 36.1 | 38 | 4.3 | 13.5 | 790 | |

| including | 38.6 - 42.7 | 4.1 | 96 | 13.9 | 26.4 | 1721 | |

| C77-5 | 29 - 46.5 | 17.5 | 203.9 | 13.4 | 14.8 | 1273 | |

| C77-6 | 33.5 - 56.2 | 22.7 | 101 | 12.3 | 8 | 822 | |

| including | 48.8 - 50.6 | 1.8 | 51.9 | 11.8 | 21.1 | 1370 | |

| and including | 52.6 - 56.2 | 3.6 | 241 | 28.7 | 16.9 | 1840 | |

| C77-7 | 195.1 - 196.9 | 1.8 | 6.8 | 0.59 | 5.83 | 296 | |

| C77-9 | 65.5 - 68.6 | 3.1 | 46 | 2.4 | 23.8 | 1225 | |

| and | 73.2 - 74.7 | 1.5 | 19.8 | 1.7 | 9 | 488 | |

| and | 102.4 - 103 | 0.6 | 94.7 | 2.8 | 13 | 781 | |

| C77-11 | 131.7 - 135.3 | 3.6 | 75 | 2.1 | 35.4 | 1787 | |

| C77-15 | 49.7 - 67.8 | 18.1 | 51.8 | 5.4 | 20.3 | 1152 | |

| including | 49.7 - 53.8 | 4.1 | 49.7 | 4.9 | 38.8 | 2000 | |

| and including | 63.3 - 67.8 | 4.5 | 57.6 | 4.5 | 31.9 | 1674 | |

| C77-18 | 47.2 - 57.9 | 10.7 | 16 | 2 | 4.9 | 301 | |

| C77-24 | 80.8 - 82.9 | 2.1 | 49.9 | 3.6 | 15.5 | 875 | |

| Discovery | C77-19 | 29.6 - 35.7 | 6.1 | 27 | 1.5 | 22.2 | 1106 |

| and | 53.3 - 54.7 | 1.4 | 14 | 0.2 | 24.2 | 1150 | |

| C77-23 | 25.0 - 29.6 | 4.6 | 54 | 6.2 | 11.2 | 752 | |

| C77-27 | 28.0 - 31.4 | 3.4 | 63 | 6.0 | 8.8 | 643 | |

| C77-29 | 31.4 - 32.9 | 1.5 | 17 | 1.3 | 8.5 | 451 | |

| and | 39.9 - 41.4 | 1.5 | 77 | 6.7 | 8.2 | 649 | |

| and | 54.6 - 56.1 | 1.5 | 6.9 | 0.5 | 11.5 | 558 | |

| Nadaleen | CSN-4 | 149.7 - 151.2 | 1.5 | 3.4 | 0.75 | 5.25 | 270 |

| Trent | C77-12 | 64.9 - 68.3 | 3.4 | 4.1 | 0.3 | 10.5 | 503 |

| and | 101.5 - 102.7 | 1.22 | 23 | 2.5 | 28.2 | 1410 | |

| C77-17 | 4.6 - 8.8 | 4.26 | 48 | 4.30 | 24.1 | 1295 | |

| and | 32.0 - 33.2 | 1.2 | 2.4 | 0.2 | 8.5 | 405 | |

| and | 46.3 - 53.0 | 6.7 | 12 | 1.6 | 20.3 | 1005 | |

| CST-2 | 144.8 - 146.3 | 1.5 | 14 | 0.87 | 7.75 | 400 | |

| and | 152.1 - 153.6 | 1.5 | 21 | 0.70 | 17.4 | 853 | |

| C11-01 | 33.0 - 120.39 | 87.39 | 6.76 | 0.49 | 4.06 | 210 | |

| including | 35.51 - 40.59 | 5.08 | 76.5 | 5.24 | 30.65 | 1656 | |

| C11-02 | 112.78 – 118.87 | 6.09 | 17.8 | 2.02 | 4.84 | 301 | |

| C11-03 | 109.73 – 112.78 | 3.05 | 25.7 | 3.28 | 5.74 | 387 | |

| C11-05 | 280.38 – 282.72 | 2.34 | 152 | 1.27 | 9.88 | 649 | |

| C11-09 | 259.41 – 260.00 | 0.59 | 54.2 | 5.44 | 18.5 | 1072 | |

| C12-18 | 134.51 – 136.25 | 1.74 | 22.9 | 2.45 | 21.6 | 1101 |

Sample Intervals are based on measured drill intercept lengths, true thickness is unknown

¹ Silver equivalent (AgEQ) values assume $25.26/oz silver, $1.04/lb lead, $1.72/lb zinc, and 100% metallurgical recovery

Mineralization in the five zones in the eastern part of the Craig Belt is principally controlled by silicified breccia structures, which appear to be related to solution collapse and karst development. Sphalerite and galena are the major sulphides present, while pyrite and tetrahedrite occur in minor amounts. Sulphides occur as disseminations, erratic replacements of dolomite, pore fillings in dolomite, vein fillings of fractures and faults, and matrix filling of breccias. Smithsonite and hydrozincite are common in outcrop. Surface sampling completed by Strategic at the Trent, Azure, Discovery and Nadaleen zones has returned peak values of 283 g/t silver, 53.3% lead, 27.4% zinc and 4.7% copper (Figure 6).

Little is known about the Scott Zone in the western part of the belt. It is a galena-rich vein and is separated from the other zones by a large thrust fault. Although it lies directly along trend of the Craig Belt, it may be related to similar silver-lead veins located about 5 km to the west on the Rod property.

Technical information in this news release has been approved by Heather Burrell, P.Geo., a senior geologist with Archer, Cathro & Associates (1981) Limited and qualified person for the purpose of National Instrument 43-101.

About Strategic Metals Ltd.

Strategic is a project generator with 11 royalty interests, 8 projects under option to others, and a portfolio of more than 100 wholly owned projects that are the product of over 50 years of focussed exploration and research by a team with a track record of major discoveries. Projects available for option, joint venture or sale include drill-confirmed prospects and drill-ready targets with high-grade surface showings and/or geochemical anomalies and geophysical features that resemble those at nearby deposits.

Strategic has a current cash position of $7 million and large shareholdings in several active mineral exploration companies including 32.8% of Broden Mining Ltd., 38.9% of GGL Resources Corp., 33.5% of Rockhaven Resources Ltd., 19.6% of Honey Badger Silver Inc., 15.7% of Precipitate Gold Corp. and 18.0% of Silver Range Resources Ltd. All these companies are well funded and are engaged in promising exploration projects. Strategic also owns 15 million shares and 5 million warrants of Terra CO2 Technologies Holdings Inc., a private Delaware corporation which recently completed another large financing to advance its environmentally friendly, cost-effective alternative to Portland cement. The current value of Strategic's stock portfolio is approximately $30 million.

ON BEHALF OF THE BOARD

"W. Douglas Eaton"

President and Chief Executive Officer

For further information concerning Strategic or its various exploration projects please visit our website at www.strategicmetalsltd.com or contact:

|

Corporate Information Strategic Metals Ltd. W. Douglas Eaton President and C.E.O. Tel: (604) 688-2568 |

Investor Inquiries Richard Drechsler V.P. Communications Tel: (604) 687-2522 NA Toll-Free: (888) 688-2522 rdrechsler@strategicmetalsltd.com http://www.strategicmetalsltd.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of exploration and other risk factors beyond its control, and actual results may differ materially from the expected results.