Strategic Metals exposes 2.1 m grading 20.54 g/t Gold at its Kluane Project, southwestern Yukon

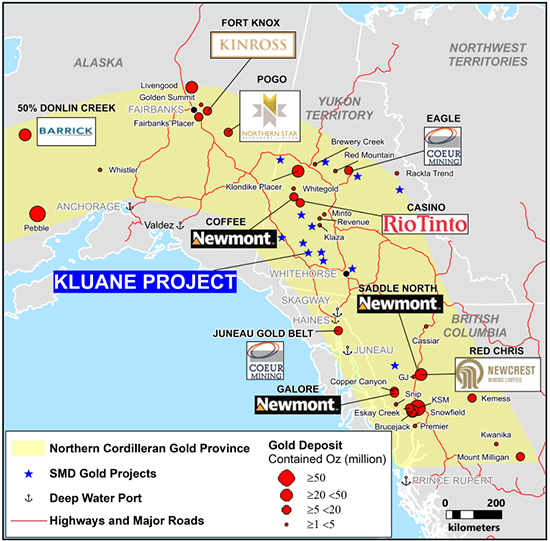

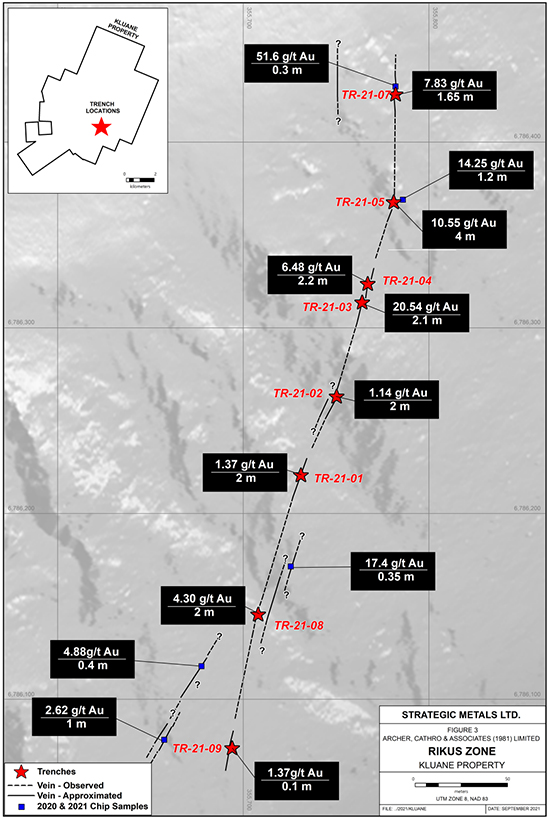

Vancouver, B.C. – October 5, 2021 – Strategic Metals Ltd. (TSX-V: SMD) ("Strategic") announces promising results from a program of geological mapping, prospecting and hand trenching, which was recently completed at its Kluane gold project in southwestern Yukon (Figure 1). The project hosts an extensive system of high-grade gold veins, one of which was trenched in 2021. Highlights from recent trenching at the Rikus Vein include:

- 20.54 g/t gold over 2.1 m including 40.5 g/t over 0.98 m;

- 13.84 g/t gold over 2 m including 27.2 g/t gold over 1 m;

- 8.60 g/t gold over 5 m including 18.6 g/t over 2 m;

- 7.83 g/t gold over 1.65 m including 20.6 g/t gold over 0.57 m; and

- 6.48 g/t gold over 2.2 m including 11.25 g/t gold over 1.2 m.

"Hand trenching has now identified attractive drill targets in several locations within this camp-scale property, and follow-up of strong geochemical and geophysical anomalies offers excellent potential for additional discoveries" states Doug Eaton, CEO of Strategic Metals. "We believe that the Kluane project could host the next multi-million ounce deposit in Yukon".

The Kluane project is located 45 km north-northwest of Haines Junction, 29 km west of the Aishihik hydro-electric dam and 10 km from the closest road. It lies within the Traditional Territory of the Champagne and Aishihik First Nation, which have signed a land claim agreement with Yukon and Canada and an exploration benefits agreement with the Company. The project comprises 279 contiguous mineral claims encompassing an area totalling approximately 5550 hectares (55.5 sq. km.).

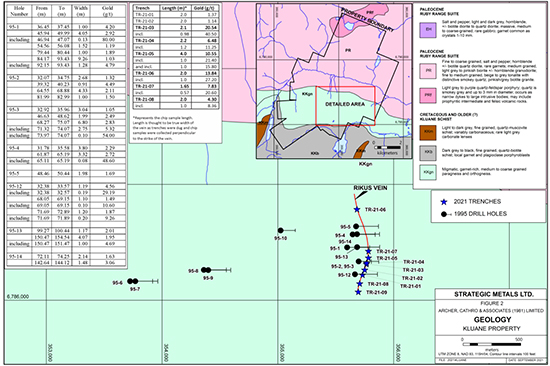

The Kluane vein system straddles the Kluhini River thrust fault, which juxtaposes Cretaceous and older, schist and paragneiss units of Kluane schist to south with granodiorite and quartz-diorite phases of the Paleocene, Ruby Range batholith to the north. Mineralized veins have been discovered across the entire project area, in both the metamorphic and intrusive rocks. The 2021 hand trenches are located in the southeastern part of the claim block where the veins are discordant to foliation and layering in the metamorphic host rocks (Figures 2 and 3). The trenches and nearby historical drill holes trace the mineralization over a length of 710 m and through a vertical range of 185 m. The following table shows results from the trenches. Historical drilling supports the trench results but the relatively shallow, small diameter holes had poor core recoveries, averaging about 50% in veins. Drill results appear as an insert on Figure 2.

|

Trench |

Length |

Au (g/t) |

|

TR-21-01 |

3.00 |

1.09 |

|

TR-21-02 |

2.00 |

1.14 |

|

TR-21-03 |

2.10 |

20.54 |

|

Including |

0.98 |

40.50 |

|

TR-21-04 |

2.20 |

6.48 |

|

Including |

1.20 |

11.25 |

|

TR-21-05 |

5.00 |

8.60 |

|

Including |

2.00 |

18.60 |

|

TR-21-06 |

2.00 |

13.84 |

|

Including |

1.00 |

27.20 |

|

TR-21-07 |

1.65 |

7.83 |

|

Including |

0.57 |

20.60 |

|

TR-21-08 |

4.00 |

2.22 |

|

Including |

1.00 |

8.36 |

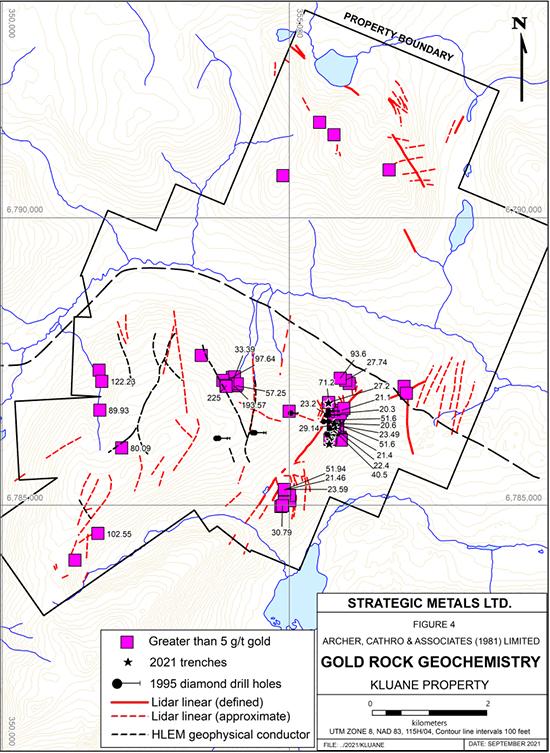

Mineralized veins contain sulphide minerals and occasionally coarse native gold, in a gangue comprised of milky white, granular to massive quartz and lesser, tan to cream carbonate. The sulphide minerals occur as disseminations and in semi-massive bands. Arsenopyrite is by far the most abundant sulphide mineral but traces of galena, chalcopyrite and pyrite have been noted. Most mineralized veins are scorodite-stained at surface because sulphide minerals are usually wholly or partially oxidized. Mineralized veins rarely outcrop and are usually marked by north-trending recessive topographic linears. Samples of mineralized vein material typically contain greater than 5 g/t gold, with the highest grade rock sample assaying 225 g/t gold (Figure 4).

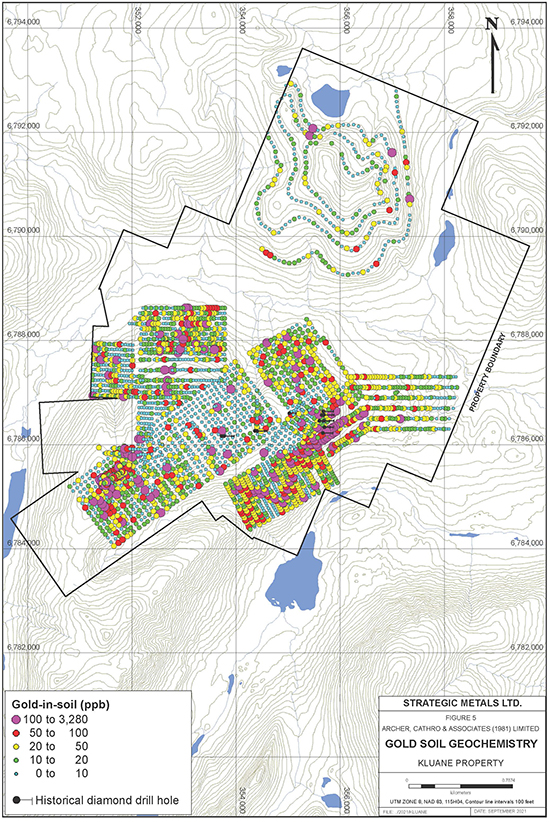

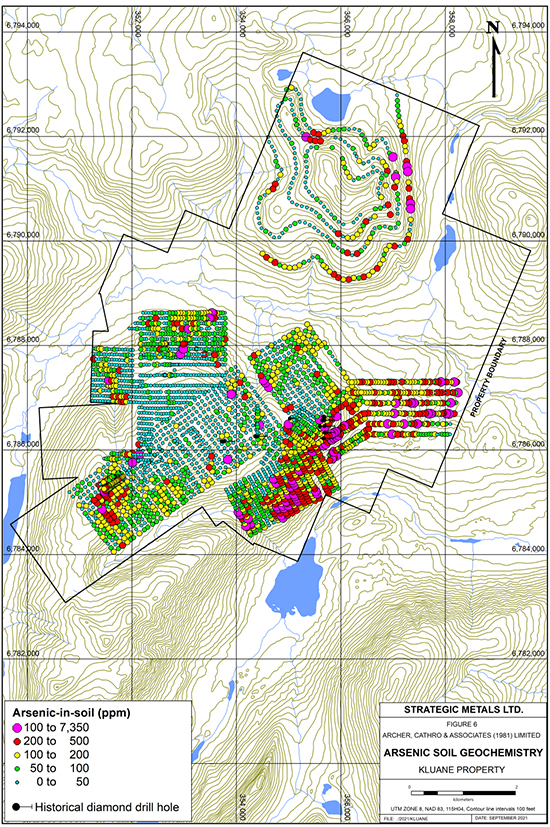

Soil geochemical sampling has outlined numerous strong anomalies for gold and/or arsenic, some of which form relatively continuous bands that are more than 2000 m long. Several of the soil anomalies coincide with the surface traces of known veins, but many others are unexplained. Peak soil values are 3280 ppb gold and 7350 ppm arsenic (Figures 5 and 6). A horizontal-loop electromagnetic (HLEM) survey that was conducted over part of the property identified a number of conductors, which coincide with known veins and soil geochemical anomalies (Figure 4). Some of these conductors are in areas of deep and/or frozen overburden, which has hampered prospecting and trenching efforts. Property-wide LiDAR imaging has highlighted several recessive linears that have not been systematically prospected or soil sampled (Figure 4).

Age dating and tectonic reconstruction to allow for displacement along the nearby Denali fault suggest that the veins at the Kluane project may belong to the same metallogenic event as the highly-productive orogenic veins of the Juneau gold belt, located to the south in Alaska (Figure 1). Mines in the Juneau belt produced at total of 6.7 million oz of gold prior to 1945 and production continues at the Kensington Mine, which is owned by Coeur Mining. However, magnetic data and strong positive correlations of gold with tungsten and bismuth, suggest that there may also be some over-printing by an intrusion-related hydrothermal system at the Kluane project.

Rock sample preparation and multi-element analyses were carried out at ALS in Whitehorse, YT and North Vancouver, BC, respectively. Each sample was dried, fine crushed to better than 70% passing 2 mm and then a 250 g split was pulverized to better than 85% passing 75 microns. The fine fractions were analyzed for gold by fire assay followed by atomic absorption (Au-AA24) and 48 other elements by inductively coupled plasma-mass spectrometry (ME-MS61). An additional 50 g charge was further analysed for gold by gravimetric analysis (Au-GRA22).

Technical information in this news release has been approved by Heather Burrell, P.Geo., a senior geologist with Archer, Cathro & Associates (1981) Limited and qualified person for the purpose of National Instrument 43-101.

About Strategic Metals Ltd.

Strategic is a project generator with 11 royalty interests, 8 projects under option to others, and a portfolio of more than 100 wholly owned projects that are the product of over 50 years of focussed exploration and research by a team with a track record of major discoveries. Projects available for option, joint venture or sale include drill-confirmed prospects and drill-ready targets with high-grade surface showings and/or geochemical anomalies and geophysical features that resemble those at nearby deposits.

Strategic has a current cash position of $7.5 million and large shareholdings in a number of active mineral exploration companies including 40% of Broden Mining Ltd., 38.9% of GGL Resources Corp., 33.5% of Rockhaven Resources Ltd., 19.9% of Honey Badger Silver Inc., 19.2% of Precipitate Gold Corp. and 18.7% of Silver Range Resources Ltd. All of these companies are well funded and are engaged in promising exploration projects. Strategic also owns 21.9% of Terra CO2 Technologies Holdings Inc., a private Delaware corporation which recently completed a US$9.2 million financing to advance its environmentally-friendly, cost-effective alternative to Portland cement. The current value of Strategic's stock portfolio, excluding Broden is approximately $22 million.

ON BEHALF OF THE BOARD

"W. Douglas Eaton"

President and Chief Executive Officer

For further information concerning Strategic or its various exploration projects please visit our website at www.strategicmetalsltd.com or contact:

Corporate Information

Strategic Metals Ltd.

W. Douglas Eaton

President and C.E.O.

Tel: (604) 688-2568

Investor Inquiries

Richard Drechsler

V.P. Communications

Tel: (604) 687-2522

NA Toll-Free: (888) 688-2522

rdrechsler@strategicmetalsltd.com

http://www.strategicmetalsltd.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of exploration and other risk factors beyond its control, and actual results may differ materially from the expected results.